The Yangon residential property sales market is in a very different condition from this time last year according to research from real estate firm Slade Property Services.

The amount of new projects being launched has skyrocketed, and blue construction hoardings are now a familiar sight around the city however, during the past six months this increase in available units has been matched with a marked decrease in take-up, with the market undergoing a noticeable slowdown.

This is partly due to an oversupply of stock, as the Law continues to restrict the majority of real estate purchases to Myanmar citizens, but there is also a marked climate of uncertainties having a negative effect on buyers’ sentiment.

The firm explored these factors in more depth below.

CURRENT AND FUTURE SUPPLY

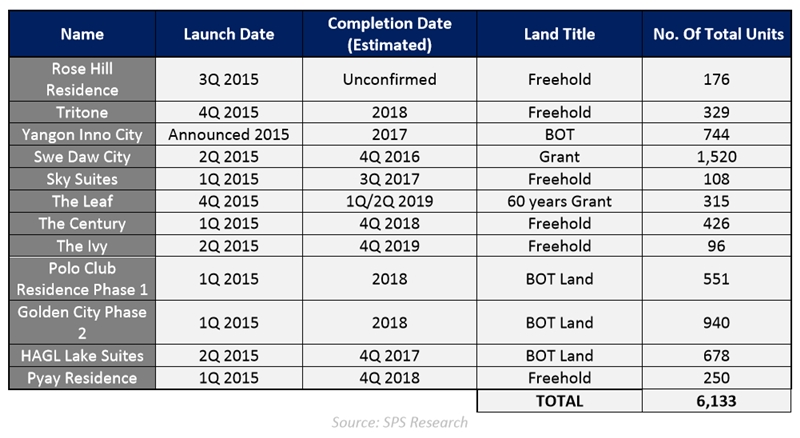

We have seen a continuation and expansion of the trends that began to surfacein 2014, namely the launch of many new residential projects. In 2014, the market saw 4,150 new residential units, itself a large increase on 2013 stock. During 2015 the number of new units brought to the market was up almost 150 percent on 2014’s tally, with more than 6,000 new units being launched since the start of the year.

Out of all of these new projects, it is our understanding that only one or two schemes are fully-funded. All the others are relying on pre-sales to raise the capital with which to complete, or even commence, construction. In a market with a large consumer base this would not be a problem’ however the Myanmar market is extremely limited in its potential sales base for a number of reasons.

Out of all of these new projects, it is our understanding that only one or two schemes are fully-funded. All the others are relying on pre-sales to raise the capital with which to complete, or even commence, construction. In a market with a large consumer base this would not be a problem’ however the Myanmar market is extremely limited in its potential sales base for a number of reasons.

Firstly, until now only Myanmar citizens have been able to buy property. A Condominium Law, which will allow foreigners to buy up to 40 percent of units in condominium towers, has just been passed in parliament however it is yet to be signed by the President. It is not yet clear exactly which projects will fall under the law’s definition of a condominium. It seems unlikely that many existing or pipeline schemes will benefit from this new law.

Secondly, only a limited number of Myanmar citizens possess sufficient capital to buy real estate. As a result of this limited sales base, supply is outstripping demand and it is unlikely that all of the units currently on the market will be sold. Without the necessary uptake those schemes relying on pre-sales may never complete, or even begin construction. Slade Property Services predicts that in the next six to twelve months, we will see the failure of several of these schemes.

Such a turn of events will spook the market in the short-term but will also prove advantageous to those projects which already have funding in place, as long as they can get the message out that they are secure investments. For this reason a strong and clear marketing campaign is essential to a successful project.

SALES PRICES AND TAKE-UP RATES

The average price for a unit in projects launched during 2015 was US$ 368 per sq ft (based on an exchange rate of 1,285 MMK: 1 US dollar). At the same time the average size for a unit was more than 2,500 sq ft. Developers continued to prefer building very large, family-sized units, with three or more bedrooms. When these two factors are combined, and the price per sq ft is applied on this large scale, many units end up costing as much as US$ 500,000 and this puts them out of the reach of all but the richest Myanmar citizens. Despite this fact, we have not observed any significant decreases in prices at most projects over the last year, and this could be seen as a contributory factor in the current slow take up rate for residential real estate.

Indeed the relative success of the HAGL project, which has achieved almost 40 percent take-up of its first two towers, could logically be attributed to its comparatively low prices (both on a per sq ft and an overall basis.)

MARKET SENTIMENT

In our opinion however, oversupply and high prices only go so far to explain the current market immobility. More influential, we feel, is an underlying climate of uncertainty. This uncertainty takes many forms.

Firstly, buyers and developers are facing uncertainties regarding land title. Freehold is a rare commodity in Myanmar, but there is currently no real clear legal differentiation between land and building title, so it has frequently been unclear what product the buyer is actually purchasing, leaving many investors with a different product from that advertised.

More recently, projects such as HAGL have successfully marketed properties on a 70-year BOT long lease, making it very clear to buyers what they are purchasing. This sort of approach gives investors piece of mind and the ability to plan their portfolios over a defined period of time.

Despite this fact, however, investor and buyer confidence has recently been severely shaken by the cancellation of five projects close to the Shwedagon Pagoda in central Yangon. The most prominent of these were Dagon City 1 and Dagon 2, both located on Ministry of Defense BOT land.

Despite receiving planning permission and commencing pre-sales, the projects sparked concerns by the public that views of the pagoda would be blocked, and that the developments would undermine the foundations of the pagoda. In the face of planned demonstrations across the country, led by hardline nationalist monks, the President ordered the projects’ cancellation.

Compensation and an alternative site have been promised to the developers and buyers, but until the details of this are finalised and announced a great deal of nervousness and uncertainty remains.

This is likely to have an impact the sales rates at all developments in Yangon, particularly those being funded by presales, and those on BOT land. It remains to be seen how severe this impact will be and how long this negative sentiment will remain.

An additional, albeit temporary, factor in the slowdown of interest was the period of Buddhist Lent beginning in July. This three month period of devotion and religious reflection is traditionally a time when it is rare for Buddhists to move house or make real estate purchases. This had a noticeable impact on the number of sales taking place in the market during Q3 2015.

Another factor causing purchasers to hold back was the election and its aftermath. In the run-up to the vote it was by no means clear what the outcome would be, and even now that the results have been released many uncertainties remain, as the Myanmar system lays out a timeline of several months for the forming of government and the selection of a President.

Both major political parties have promised to continue the country’s economic reforms and current pro-business attitude, but until the new NLD-lead parliament sit, and starts to outline its policies, buyers are likely to remain cautious.

Finally, the year-long devaluation of the Myanmar Kyat in relation to the US Dollar is causing many buyers to hesitate. The exchange rate has dropped almost 30 percent from around 1,000 MMK:1 US$ to 1,290 MMK:1 US$ in the space of less than a year. As a result, those apartments priced in US dollars are becoming more and more expensive in real terms to those Myanmar citizens who are paid in their local currency. This is particularly worrying for schemes with staggered payment plans, as buyers have no way of predicting how much each future payment installment will be worth in real terms. With some payment plans lasting over a year, and the rate continuing to rise, buyers are afraid that they will end up paying much more than they originally budgeted for when agreeing to buy the unit.

The Central Bank has recently introduced some new measures to combat the weakening of the Kyat, and exchange rates have fallen a small amount already, so it is hoped that this will not be a long term problem. However in the meantime, developments quoting prices in Myanmar Kyat, or applying a set US dollar exchange rates for all future payment installments will attract more buyer confidence than those continuing to charge the same price in US dollars today as at project launch.

Whilst no one issue is in itself entirely problematic, the combination of all of these factors is proving extremely damaging to the residential property market. Whilst some factors, like the election, will hopefully diminish in time, other issues such as the Myanmar Kyat devaluing can, and should, be targeted directly to lessen its impact.

FUTURE RESIDENTIAL MARKET OUTLOOK 2016

The future looks set to continue many of the trends begun during 2015. More projects are due for launch and the number of potential purchasers remains static, at least for the time being. The Condominium Law has been passed by parliament sooner than expected, but until it is signed into law by the President it is difficult to predict what impact it will have on the market.

That said, we have already noticed a sudden spike in residential uptake and interest from Myanmar citizens hoping to benefit from the future implications of the law.

Similarly, it is impossible to predict what policies the new NLD-dominated parliament will introduce, and what impact these will have on the residential market. The NLD has promised to continue economic reforms once in power, but the speed of any changes may not be very fast, particularly as the NLD is unused to governing. As a result, we predict a slow initial six months of 2016 before any significant changes occur to alter the economic or business environment. In this climate, a prudent developer would do all in its power to reassure the public that it remains a safe and stable investment.